PKF Munich - Your carve-out specialist

Due to our experience and know-how in carve-out transaction support PKF Munich has been chosen as the winner of the 2018 Corporate INTL Magazine Global Award in the category carve-out support.

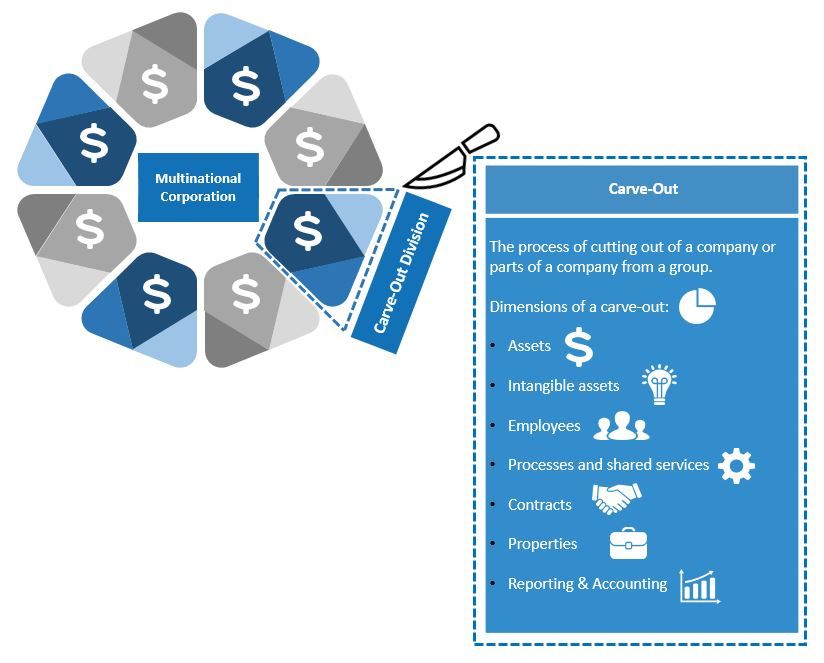

In a carve-out, companies or parts of companies are spun off and, if necessary, sold. Carve-outs arise on the one hand from focusing on the core business or a strategic restructuring of the business portfolio due to market changes. Transactions of this kind, such as the sale of selected assets, can be an important part of a company's growth strategy. Divestments and carve-outs can be used to effectively adapt companies and business portfolios. Divisions or business units are spun off in order to release them for strategically more attractive business segments. This kind of divestment process is comparable to divorce. From the design of the actual divestment to the actual spin-off, track-record proven experts are required to make a clear cut during the carve-out and to set up and accompany a structured, smooth process. The respective assets and liabilities must be precisely captured and all regulatory requirements have to be fulfilled accordingly.

PKF Munich supports you with its expertise and practical experience to implement your carve-out project in a structured, low-risk and clearly focused manner.

Learn more about our carve-out solutions and carve-out services.

Your contact person

Sebastian

Wohldorf

Munich